UK credit card APR trends you need to know

Anúncios

UK credit card APR trends are influenced by economic conditions, inflation, and market competition, impacting consumer behavior and debt management strategies significantly.

UK credit card APR trends have a significant impact on how consumers manage their finances. As these rates fluctuate, have you wondered how it affects your spending and financial planning?

Anúncios

Understanding APR and its significance

Understanding APR is crucial for anyone using a credit card. APR, or Annual Percentage Rate, indicates the cost of borrowing on a credit card. It helps you understand how much interest you will pay on outstanding balances. Many people overlook this important factor, yet knowing it can significantly impact your financial decisions.

The significance of APR lies in its ability to guide consumers. A higher APR means you’ll pay more interest over time. This can lead to increased debt if not managed properly. Therefore, understanding how APR works can empower you to make informed choices regarding credit card usage.

Anúncios

Basic components of APR

APR primarily consists of two key parts:

- Interest Rate: The percentage used to calculate interest on unpaid balances.

- Fees: Some cards include additional fees which can raise the effective APR.

It’s also essential to check if the APR is fixed or variable. Fixed APR means the rate remains the same, while variable APR fluctuates based on market conditions. If you want to avoid surprises, a fixed APR is often a safer choice.

Why Understanding APR Matters

Grasping the concept of APR can lead to better financial health. Here are some important reasons:

- It helps compare different credit cards effectively.

- Understanding APR can aid in budgeting and cash flow management.

- Keeps you informed about potential fees or penalties.

If you regularly carry a balance, even a small difference in APR can add up significantly over time. In conclusion, investing time to understand APR is beneficial as it can help you save money and manage your credit responsibly.

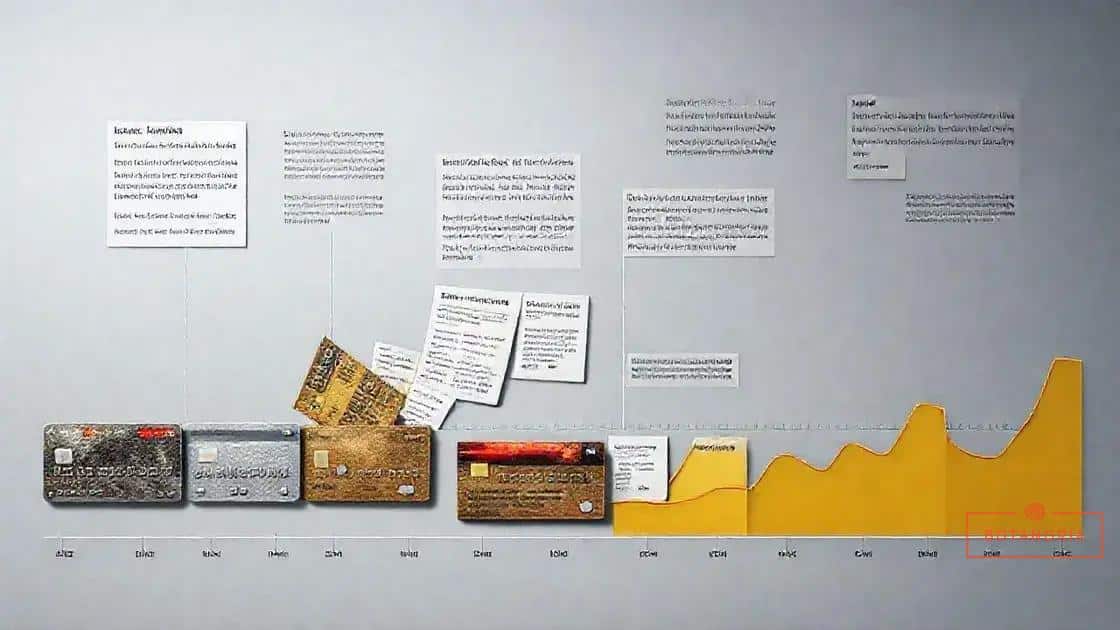

Historical perspective of credit card APR in the UK

Understanding the historical perspective of credit card APR in the UK is essential for grasping how current rates have evolved. Over the years, the landscape of credit and lending has changed, influenced by various economic factors and regulations.

Initially, credit cards were introduced in the UK in the late 1960s and early 1970s. Back then, APRs were relatively low, attracting consumers eager to embrace plastic payments. However, as credit card usage grew, so did competition among lenders, leading to increased rates.

Key milestones in APR development

The evolution of credit card APR in the UK includes significant changes:

- 1970s-1980s: Credit cards became widely accepted, and lending grew. APR rates were around 15-20%.

- 1990s: Increasing regulations aimed at protecting consumers began to shape interest rates.

- 2000s: The introduction of the Financial Services Authority brought more transparency, affecting how APRs were presented.

- 2010s-Present: Recent trends show varying rates due to market competition and economic changes.

These changes were often tied to broader economic conditions. For example, during periods of economic downturn, many lenders adjusted their rates to manage risks. The Bank of England’s base rate also plays a crucial role in influencing APRs across the market.

The impact of regulations on credit card rates

Regulatory measures have substantially influenced how APR is set in the UK. The introduction of consumer credit laws aimed to enhance clarity and fairness. It made lenders disclose APR more transparently, allowing consumers to compare offers easily. This led consumers to demand better rates and terms.

As a result, understanding historical trends helps consumers make more informed decisions today. Knowing how APRs have shifted can provide insights into predicting future changes and selecting the right credit card for one’s needs.

Current trends in UK credit card APR rates

Understanding the current trends in UK credit card APR rates is vital for consumers looking to manage their finances effectively. With changes in the economy, financial institutions frequently adjust their APR offerings, which can significantly impact your borrowing costs.

As of now, average credit card APRs in the UK have shown noticeable fluctuations. Rates have been influenced by various factors, including monetary policy set by the Bank of England and competition among card issuers. Many consumers may find that the rates they are offered can vary widely based on creditworthiness and other factors.

Factors influencing current APR rates

Several elements play a role in determining the APR rates offered to consumers:

- Bank of England’s base rate: Changes in this rate can directly affect credit card APRs.

- Consumer demand: Increased competition among lenders often leads to more attractive rates for consumers.

- Economic conditions: Inflation and spending patterns impact banks’ strategies regarding interest rates.

The current trend indicates a mix of offers, from low promotional rates for new customers to higher rates for those with less favorable credit scores. It’s essential to read the fine print on credit card offers, as many may come with introductory rates that can increase significantly after a set period.

Promotions and loyalty offers

Many credit cards provide promotional offers to attract new customers. This includes low or 0% APR for an introductory period. While this can be a great way to save on interest, keep in mind that the rates might spike significantly after that period ends.

Furthermore, card issuers often have rewards programs that can further affect APR. For instance, rewards might come with higher annual fees and, consequently, higher interest rates. Knowing which offers align with your spending habits is crucial for maximizing benefits.

Staying informed about current trends in APR rates can help you make better financial decisions, ensuring that you find the best credit card options available that suit your needs.

Impact of credit card APR on consumer behavior

The impact of credit card APR on consumer behavior is profound. Credit card APR rates influence how individuals spend, save, and manage their finances. When faced with high interest rates, consumers often make significant changes to their purchasing habits.

For many, a higher APR can lead to more cautious spending. People become more aware of their balances and are less likely to carry debt. This shift occurs because they want to avoid paying extra in interest. Conversely, lower APRs can encourage spending, as consumers feel they can manage their debt more easily.

Debt management strategies

Many consumers devise strategies to handle their credit card debt effectively. Here are some common approaches:

- Paying more than the minimum: Consumers are more likely to pay above the minimum amount when APR is high, aiming to reduce principal faster.

- Transferring balances: Some individuals transfer balances to cards with lower APRs to save on interest costs.

- Creating budgets: Higher interest rates encourage stricter budgeting, focusing on controlling expenses.

The decision to switch credit cards often stems from a desire to lower APRs. Consumers compare rates and look for cards with promotional offers. Many seek out rewards programs that provide benefits without the downside of high interest. Others may choose not to use credit cards at all, opting instead for cash or debit for everyday purchases.

Behavioral influences

The perception of credit card APR also affects consumer psychology. If an individual understands that a higher APR means higher costs, they may become more disciplined in their purchasing decisions. This awareness can influence their approach to savings. People may prioritize creating an emergency fund over using credit cards for unplanned expenses.

Moreover, the impact extends to how individuals view credit as a whole. Consumers often develop a more cautious attitude towards borrowing. As they become aware of how APR affects their finances, they may become more educated on financial literacy overall.

In this way, APR does not just influence individual transactions—it shapes full financial behaviors and attitudes over time.

Future predictions for UK credit card APR trends

Future predictions for UK credit card APR trends are shaped by various economic indicators and market behaviors. Understanding these trends can help consumers make informed financial decisions. Analysts often look at data such as inflation rates, changes in the Bank of England’s base rate, and consumer spending patterns to forecast future APR movements.

As the economy fluctuates, credit card APRs are likely to respond accordingly. Currently, there are signs that rates might stabilize after periods of significant fluctuation. This stabilization could provide consumers with clearer choices when selecting credit cards.

Influences on future trends

Several key factors will play a role in shaping the future of credit card APRs:

- Economic recovery: As the economy improves, consumer confidence may rise, influencing spending habits.

- Inflation rates: Higher inflation generally leads to higher interest rates. If inflation remains steady or declines, APRs may follow suit.

- Market competition: Many banks offer competitive rates to attract new customers. Increased competition may keep rates lower.

Furthermore, innovations in technology and financial products may influence how credit cards are structured. For instance, the emergence of fintech companies offering flexible repayment options could reshape traditional APR models. Consumers are increasingly attracted to products that provide more transparent terms and lower costs.

Expected consumer behavior changes

As APR trends evolve, consumer behavior will also change. Higher rates might encourage individuals to pay down existing debt more aggressively. On the other hand, stable or lower rates may lead consumers to utilize credit more freely, impacting overall spending.

Education on APR and its implications will likely become more vital. Consumers must understand how future changes in credit card APR could affect their financial health. By staying informed, they can adjust their strategies to manage debt and maximize rewards effectively.

In conclusion, understanding UK credit card APR trends is essential for making smart financial decisions. As we’ve explored, various factors like economic conditions, inflation, and market competition play significant roles in shaping these rates. Being aware of how APR affects behavior can help consumers manage debt wisely and choose the right credit products. Staying informed about potential future trends will allow individuals to make the best decisions for their financial well-being.

\n\n\n

\n

\n

FAQ – Frequently Asked Questions about UK Credit Card APR Trends

What does APR stand for and why is it important?

APR stands for Annual Percentage Rate, and it is crucial because it indicates the cost of borrowing on a credit card, helping consumers understand how much interest they will pay.

How do economic factors influence APR rates?

Economic factors such as inflation and the Bank of England’s base rate directly impact APR rates. When the economy improves, APRs may stabilize or decrease.

What strategies can I use to manage credit card debt?

You can manage credit card debt by paying more than the minimum payment, transferring balances to cards with lower APRs, and creating a budget to control your spending.

Are promotional credit card rates worth it?

Promotional rates can be beneficial if you plan to pay off the balance before the rate increases. However, always read the terms to understand how long the promotional rate lasts.